If you make a contribution to Pet Alliance of Greater Orlando through your IRA, you’ll be saving the lives of homeless pets and you’ll get great benefits, too!

A charitable IRA rollover is a wonderful option for people 70 ½ years of age and older. That’s because it allows you to make a gift to the animals — from $100 to $100,000 — and the distribution won’t count as taxable income. An IRA rollover is also a great option if you don’t normally itemize your charitable deductions. It is possible to give individual retirement account (IRA) assets to charity, free from federal tax, annually.

Commonly Asked Questions

Hover over the boxes for more information.

What’s a charitable IRA rollover?

Is my IRA rollover gift deductible?

Who benefits most from an IRA rollover?

When do I need to make my gift?

If you have additional questions about making a charitable IRA Rollover or planned giving, please contact Cathy Rodgers at crodgers@petallianceorlando.org.

Looking for more planned giving options? Check out the following resources:

- Planned Gifts (Wills, 401(k), 403(b), annuities, Keogh, and pension plans)

- Stock Gifts

- Pawsitive Care

Additional ways to give:

Latest Blog Posts

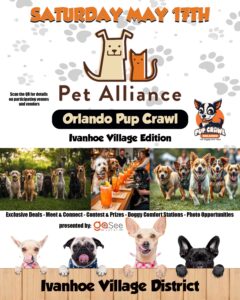

Orlando Pup Crawl

Join Us for the Pet Alliance Pup Crawl in Ivanhoe Village! Join us on May 17th from 4 PM to 8 PM for the

Join Us Virtually for Kitten Con!

The Kittens Are Coming! This March, we’re launching Kitten Con, an educational celebration to help our organization and community get ready for Kitten Season! Each

Construction Has Begun on Our New Orlando Shelter

We’re so excited to announce that construction has begun on our new Orlando shelter! As the future home of the Kylie J. Capri Campus and